Stock prices dipped sharply after news of an attempted military coup in Thailand was reported.

Stocks, oil and US dollar currency are down, while bonds and gold are up.

From the AP news wire:

Traders watching Thailand closely are certain to remember how trouble in the kingdom has had worldwide implications in the past: The Asia currency crisis that erupted in 1997 began with the devaluation of the Thai baht, then snowballed into an international economic downturn. The baht fell sharply Tuesday.

Thailand Prime Minister Thaksin Shinawatra, who was in New York attending the United Nations General Assembly, faced calls to step down amid allegations of corruption and abuse of power.

The news hit the market on a day stocks had been drifting lower following a sharp drop in the pace of U.S. housing starts in August. Housing starts fell 6 percent, twice as fast as expected. New housing construction notched its fifth decline in six months, hitting its lowest point in more than three years.

This uncertainty with Thailand as well as the poor US economic indicators and data is hitting the stock markets hard. If these various issues remain uncertain, we will see shaky action in the markets with the possibility of a minor correction wiping out many summer gains. I would like to see the Thailand issue resolved swiftly and peacefully, which would bolster the Asian and US stock markets.

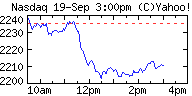

Here’s a look at the Nasdaq index right now: